Klarna: What Is It?

Klarna is a Swedish fintech company founded in 2005 that offers "Buy Now, Pay Later" (BNPL) services. It allows shoppers to split payments into interest-free installments, pay after delivery, or finance purchases over time. Klarna partners with over 500,000 merchants globally and serves more than 150 million customers.

How Does Klarna Payment Work?

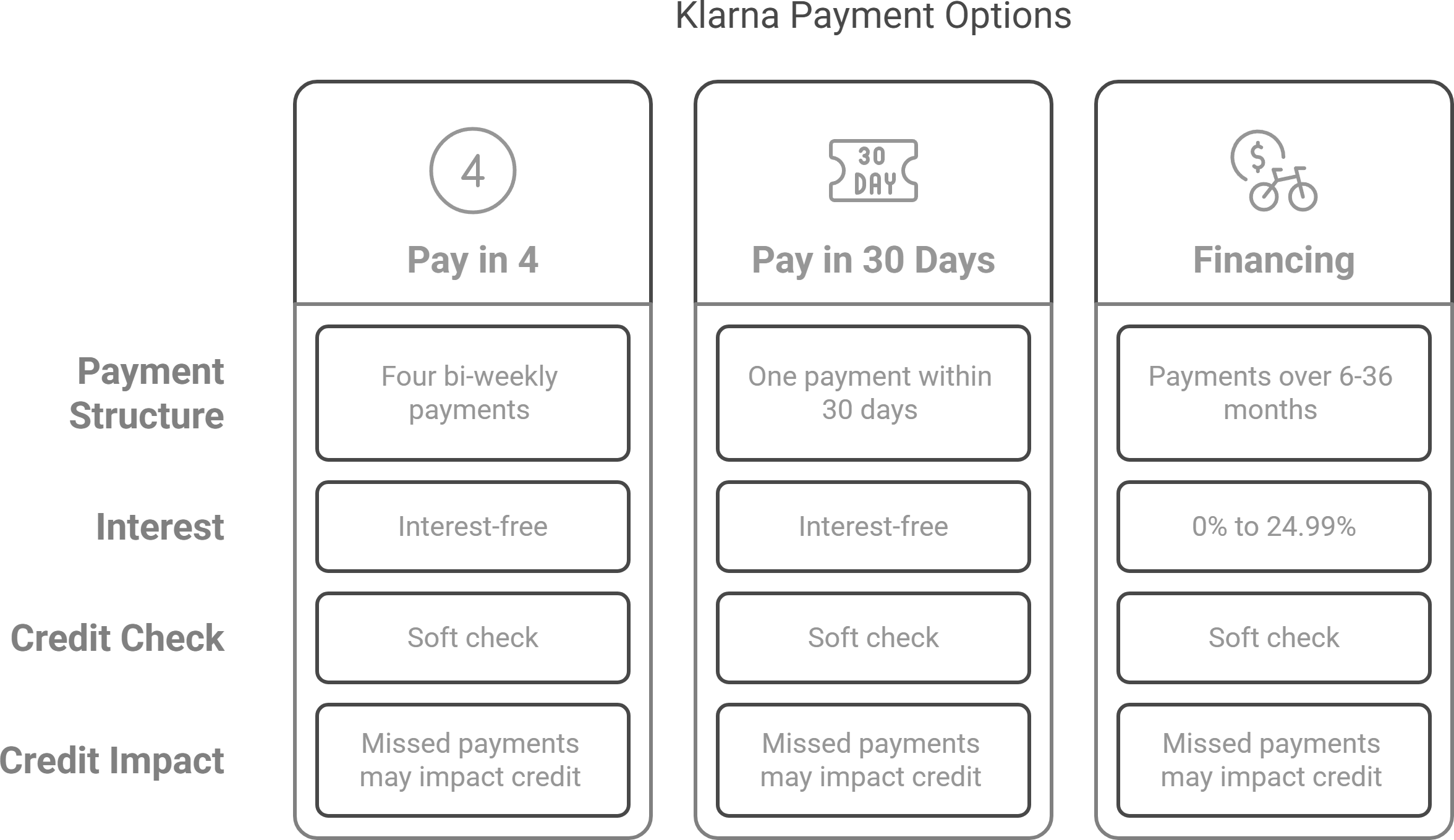

Klarna offers several payment options:

- Pay in 4: Split the total cost into four equal, interest-free payments every two weeks.

- Pay in 30 Days: Receive your order and pay the full amount within 30 days, interest-free.

- Financing: Spread payments over 6 to 36 months with interest rates ranging from 0% to 24.99%.

Klarna performs a soft credit check that doesn't affect your credit score. However, missed payments can lead to late fees and may impact your credit.

Why Do People Use Klarna To Pay?

- Flexibility: Manage cash flow by spreading out payments.

- Convenience: Quick and easy checkout process.

- No Interest (if paid on time): Avoid interest charges with timely payments.

- Wide Acceptance: Available at numerous online retailers, including fashion, electronics, and beauty stores

Klarna Refunds & Returns: What You Need to Know

How Does a Refund Work with Klarna?

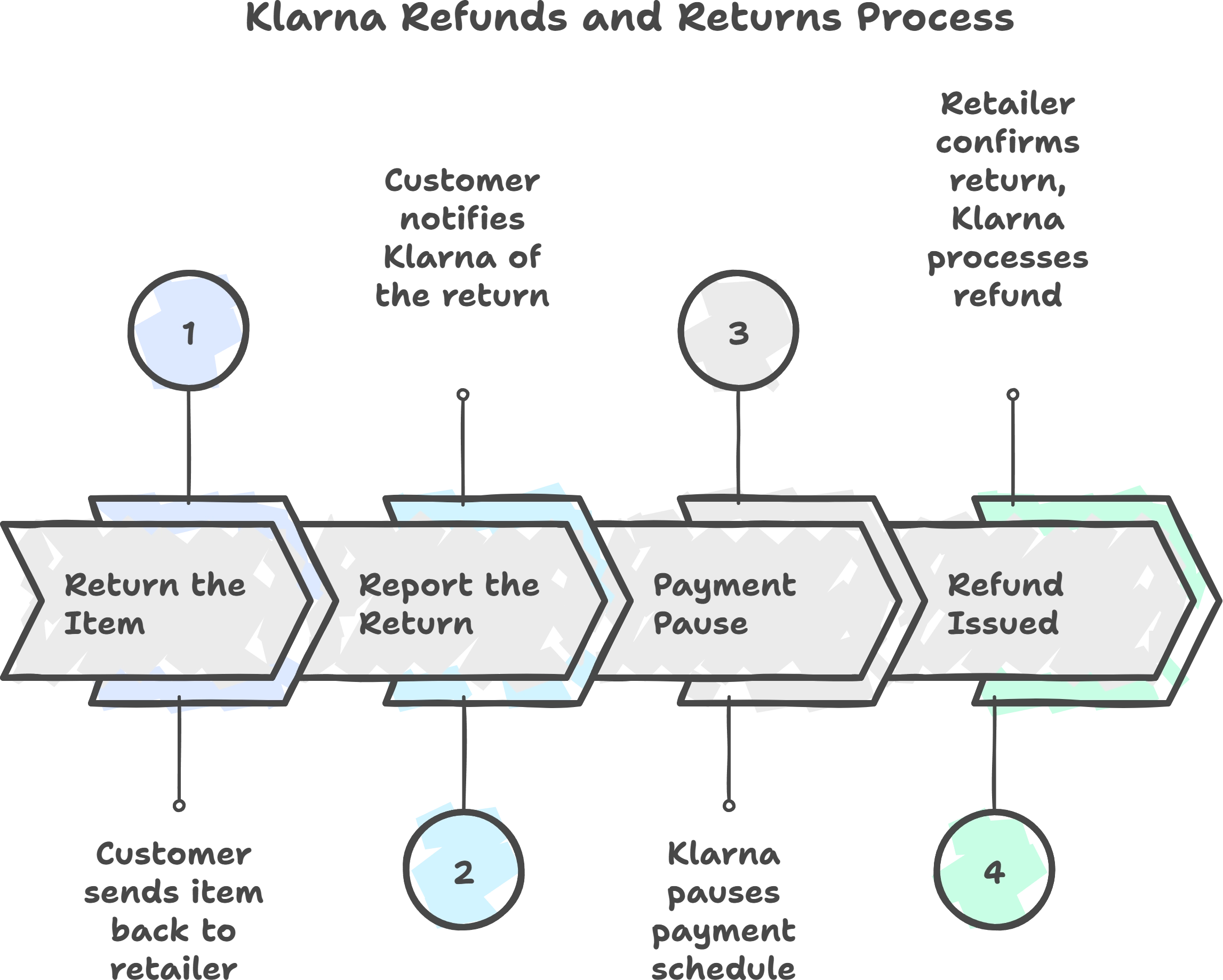

When you return an item purchased through Klarna, the refund process involves both the retailer and Klarna. Here's how it works:

- Initiate the Return: Follow the retailer's return policy to send back the item.

- Report the Return to Klarna: Log into the Klarna app or website, go to your order, and select "Report a return." This action pauses your payment schedule, giving the retailer time to process the return.

- Refund Processing: Once the retailer confirms the return, Klarna will process your refund. If you've already made payments, Klarna will refund the amount to your original payment method. If there are remaining payments, Klarna will adjust or cancel them accordingly.

Will Klarna Refund Me If I Cancel My Order?

Yes, if you cancel your order before it ships or return it after receiving it, Klarna will refund any payments you've made. Ensure you follow the retailer's cancellation or return policy and report the cancellation or return to Klarna to pause your payment schedule.

⏱️ How Long Do Refunds Take?

Refund times can vary depending on the retailer and your financial institution. Generally, once the retailer processes the return, Klarna will issue the refund within 5 to 14 business days.

How Are Refunds and Returns Handled with Klarna?

Klarna facilitates the payment aspect of your purchase, while the retailer handles the return. Here's a step-by-step overview:

- Return the Item: Send the item back to the retailer following their return instructions

- Report the Return: Inform Klarna about the return through their app or website.

- Payment Pause: Klarna will pause your payment schedule to allow the retailer time to process the return.

- Refund Issued: Once the retailer confirms the return, Klarna will process your refund, adjusting your payment schedule accordingly.

✅ Pros and ❌ Cons

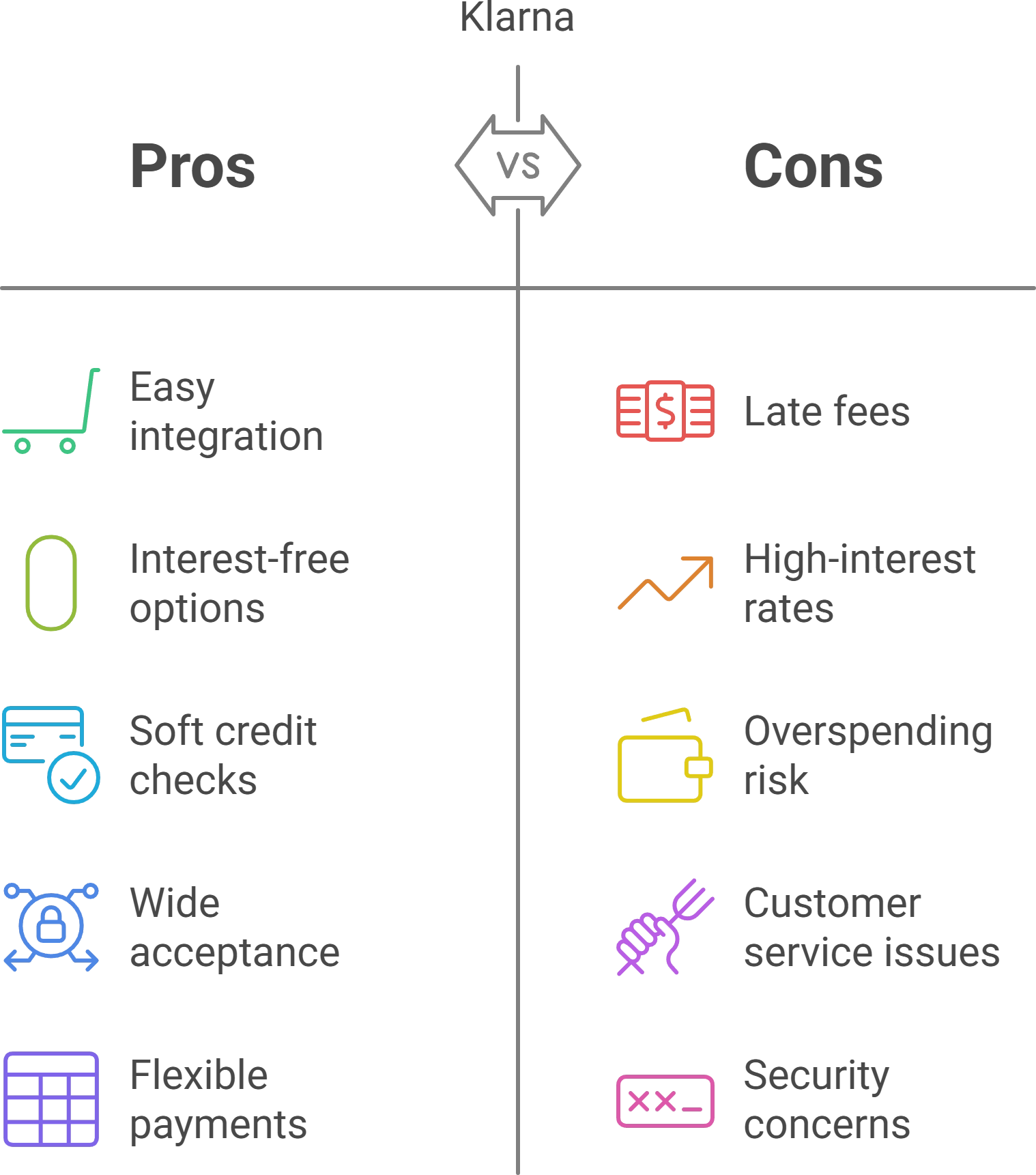

Pros:

- Easy to use and integrate with online shopping.

- No interest if payments are made on time.

- Soft credit checks for most services.

Cons:

- Late fees apply for missed payments.

- High-interest rates on financing options

- Potential for overspending due to ease of use.

- Customer service issues reported by some users.

Similar Services

Other BNPL providers include:

- Afterpay: Offers four interest-free payments over six weeks.

- Affirm: Provides financing with interest rates up to 30%.

- PayPal Pay Later: Allows deferred payments through PayPal.

- Sezzle: Allows splitting payments into four over six weeks, interest-free.

❓ FAQ

Is Klarna legit?

Yes, Klarna is a legitimate company operating globally with millions of users.

Any downsides or catches?

Missing payments can lead to late fees and potential credit score impact. Financing options may carry high-interest rates.

Is Klarna trustworthy?

While many users have positive experiences, some have reported issues with customer service and account security.

Is using Klarna a good idea?

It can be beneficial for managing cash flow if used responsibly. However, it's essential to be aware of the terms and potential fees.

Is Klarna safe to use?

Klarna employs security measures to protect user data. However, as with any financial service, users should remain vigilant against potential fraud.

How does Klarna work?

Klarna allows you to split your purchase into multiple payments, either interest-free or with financing options, depending on the plan you choose.